Introduction

The Temu project was initiated in September 2022. It stands as Pinduoduo’s third major strategic initiative following its successes in the domestic e-commerce and grocery delivery sectors. Temu has been of paramount importance within Pinduoduo, with the team being led by Gu Pingping, the former head of Duoduo Grocery. There have even been rumors suggesting that Pinduoduo’s founder, Huang Zheng, has returned to the company to provide direction for the Temu project. In February 2023, Temu made waves by securing a 30-second Super Bowl advertisement slot, garnering significant attention as a hot topic at the time. Industry experts are unanimous in their belief that Temu is poised to replace Wish’s position in the American e-commerce landscape.

In this report, we have synthesized the core viewpoints from mainstream research reports and a selection of opinions voiced by American consumers regarding Temu. We aim to provide insights into the potential development prospects of Temu in the future.

Abstract

Temu’s business model is built upon the foundation of Pinduoduo’s robust cash flow, allowing it to rapidly establish its presence in the United States through extensive advertising campaigns. However, considering the disparities between the American and Chinese markets in terms of consumer preferences and competitive landscape, alongside the decision-making tendencies of Temu’s management team, the profitability of Temu’s future remains uncertain.

- Temu aims to leverage Pinduoduo’s domestic sourcing advantages and position itself as a provider of “high-quality products at low prices,” attempting to replicate Pinduoduo’s success path in China. However, this model faces several challenges in the United States:

- Without the trust boost provided by the endorsement of a platform like WeChat, Temu may struggle to establish the “high-quality products at low prices” image among American consumers. Pinduoduo’s early expansion in China heavily relied on its collaboration with WeChat, which significantly lowered the trust threshold due to widespread sharing among friends and family, thereby rapidly boosting user numbers. In the United States, Temu lacks access to the powerful user acquisition channel of WeChat, which will inevitably prolong the process of building trust with American consumers and lead to higher costs (as discussed later);

- Temu might face fiercer competition overseas compared to the domestic market. On one hand, the American market features giants like Amazon in the mid-to-high-quality market segment (with a market cap three times that of Alibaba). On the other hand, in the emerging high-value, cost-effective e-commerce market, competitors like SheIn and TikTok exist. SheIn has already established significant consumer trust in the women’s fashion vertical and is actively expanding into other categories, while TikTok boasts nearly 1.6 billion global daily active users and years of experience operating overseas traffic. How Temu will carve out a sustainable profit margin in such a competitive environment remains to be observed;

- The cost of acquiring overseas traffic might surpass Temu’s management team’s expectations, possibly necessitating a quicker business model transformation. It requires substantial investment to establish trust with consumers and secure a position in intense competition. Moreover, we observe that American social platforms seem to have stricter control over viral marketing of the Pinduoduo kind (discussed later). If the impacts of these controls exceed Temu’s management team’s expectations, the need to address high traffic and logistics costs might force Temu to compromise on product quality, raise prices, or undertake structural transformations. Regardless of the chosen course of action, Temu’s overseas expansion will face further resistance: 1. Lowering product quality would replicate Wish’s pitfalls; 2. Price hikes would significantly affect platform traffic and sales, and while increasing prices might become necessary under heavy losses, it is an action of last resort. Reports suggest that Temu executed a comprehensive price increase for most categories on August 16; 3. Undertaking a shift in category structure might demand substantial subsidies to build user trust (similar to Pinduoduo’s billion-dollar subsidies in China). Based on Temu’s recent price adjustment, it appears that they do not intend to undertake large-scale subsidy actions in the near term.

- The Temu Management Team’s experience with the successful creation of Duoduo Grocery lends credibility to the project. However, based on our research, comparing the actual experience of Duoduo Grocery with that of Meituan Maicai (a competing grocery delivery service) or other offline grocery shopping experiences, Duoduo Grocery’s performance falls short. There have also been complaints from suppliers regarding Duoduo Grocery’s bidding policy, with some suppliers expressing concerns that the competitive bidding environment could lead to lower product quality overall. We will delve further into Duoduo Grocery’s performance in the following sections.

Recommendations

-

For suppliers planning to join Temu: Temu could be considered as one of the channels to utilize excess production capacity. In the short term, Temu is likely to continue expanding its American operations with subsidies from its parent company Pinduoduo. During this period, collaborations with Temu could be profitable. However, resources should not be overly skewed towards Temu, as this might result in the gradual loss of pricing power or bearing the risk of declining traffic at Temu in the later stages.

-

For investors in Pinduoduo: While Pinduoduo’s core e-commerce business remains robust, Temu’s profitability still holds uncertainty. If Temu is unable to successfully upgrade its brand image and enhance consumer experience, it could even face failure. Investment in Temu should be approached with caution, and the ability to smoothly transition the brand image could become a pivotal factor for its long-term survival in the United States.

Key Observations from Mainstream Research Reports

Mainstream research reports largely view Temu favorably, believing that Pinduoduo’s advantages in domestic supply chains, innovative marketing strategies, and the successful track record of the Duoduo Grocery team will contribute to Temu’s success.

However, most of these research organizations have overlooked the differences between American and Chinese consumers(Hayden Capital is an exception, as staying neutral about Temu’s future), as well as the actual shopping experiences of Pinduoduo, Duoduo Grocery, or Temu. Neglecting these factors might lead to an overly optimistic assessment of Temu. We will further discuss our conclusions based on our research into these factors.

Zheshang Securities (January 9, 2023)

Zheshang Securities is bullish on the Temu project and Pinduoduo’s stock price. Their main arguments are as follows:

- Temu has assembled the original team from Duoduo Grocery, with a highly competitive force;

- Temu replicates the creative traffic strategies from Pinduoduo’s domestic platform, facilitating rapid customer acquisition;

- Temu leverages the strong domestic supply chain of Pinduoduo, demonstrating robust supply capabilities;

- Temu’s recommendation-based e-commerce model surpasses existing search-based models in the overseas market.

Hayden Capital (January 5, 2023)

Hayden Capital has refrained from making a definitive judgment on the performance of the Temu project for now. Nevertheless, they believe that Pinduoduo’s strategic timing in investing in the Temu project demonstrates the exceptional judgment of the management team, thus fostering an optimistic outlook on Pinduoduo’s stock price prospects. In regard to viewpoints concerning the Temu project, Hayden Capital’s stance is as follows::

Pinduoduo places significant emphasis on the Temu project:

- The team led by Gu Pingping, who previously spearheaded the Duoduo Maicai project, is at the helm of the Temu project.

- Pinduoduo has acquired valuable talent by luring employees from SheIn with high salaries (3-5 times their previous income).

- An estimated investment of around 7 billion RMB is expected within a year.

Pinduoduo has strategically timed the Temu project:

- Global economic downturn has resulted in surplus production capacity in Chinese factories.

- Reduced disposable income among American consumers has led them to seek more cost-effective products (with Temu’s pricing typically being equivalent to 30%-50% of Amazon’s).

Temu will benefit from Pinduoduo’s integration of domestic suppliers:

- Pinduoduo’s initiatives such as shortening the supply chain and reducing intermediaries have boosted suppliers’ profit margins. Additionally, they’ve introduced automated advertising tools tailored for factory operations, further enhancing suppliers’ profit potential. The trust established between Pinduoduo and suppliers during this period will serve as a barrier for their future expansion into overseas markets.

Traffic presents a primary challenge during overseas expansion for Temu:

- Without the traffic boost provided by WeChat, Temu faces difficulty in achieving rapid growth overseas similar to its domestic success on Pinduoduo’s platform.

- TikTok, a direct competitor to Temu, is one of the largest sources of traffic overseas, thereby undermining Temu’s traffic acquisition channels.

China Merchants Securities(November 10, 2022)

Temu possesses two advantageous aspects that could contribute to its success in overseas competition, according to China Securities:

- Accumulated mature resources of high-quality, low-cost suppliers and operational capabilities from its domestic business;

- Learnt from the experiences of its predecessors during international expansion. For instance, it has avoided the platform model utilized by Wish and opted for a self-operated model, ensuring product quality and user experience.

China Securities believes that the preliminary annual loss of around 5 billion RMB by Temu is insufficient to significantly impact its parent company’s overall profits (315 billion RMB in 2022). In the later stages, Temu is highly likely to transform its business model (from self-operated to platform) and category structure (from low-unit price to high-unit price) to gain greater profit potential.

China Securities gives a “strongly recommended” rating for the stock of Pinduoduo, Temu’s parent company. Based on a 3-year profit forecast (year-on-year growth rates of 115%, 39%, 30%), China Securities believes that its stock price could potentially increase from $59 to $92 per share (using November 9, 2022, stock price as reference).

Zheshang Securities (September 28, 2022)

Temu holds advantages in terms of demand background, organizational capability, and business model, while simultaneously facing challenges such as high logistics costs, rising traffic expenses, and competition from e-commerce giants. Its development is promising, but its success will depend on its actual performance after business expansion.

- Demand background: A global economic downturn and decreased per capita purchasing power. Temu’s entry into the low-cost market segment exhibits strong growth momentum.

- Organizational capability: The Temu team, primarily built upon the foundation of Duoduo Maicai, is poised to replicate the operational capabilities and successful experiences of Duoduo Maicai.

- Business model: Drawing lessons from the failures of Wish, Temu has rigorously curated its merchant selection and product range, elevating user experience.

American Public Perception of Temu

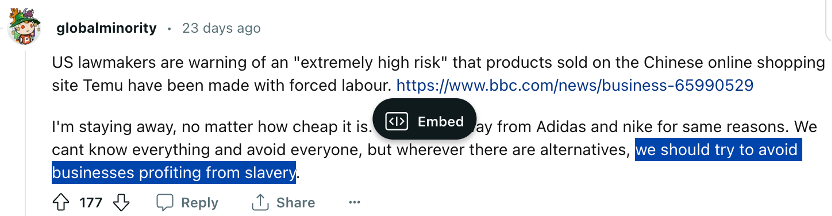

Through analyzing the most upvoted comments in Reddit posts related to “Temu”, we’ve extracted key points of discussion among users. From this, we’ve summarized the following opinions held by the American public regarding Temu:

- Concerns about Temu’s low prices. In discussions with high upvote counts, opinion leaders express apprehensions that low prices might come at certain costs, including:

- Unethical labor relations. Some users point out that low-priced goods often involve labor exploitation. Additionally, counterarguments suggest that labor exploitation isn’t exclusive to Temu and that Temu’s offerings at least come at lower prices.

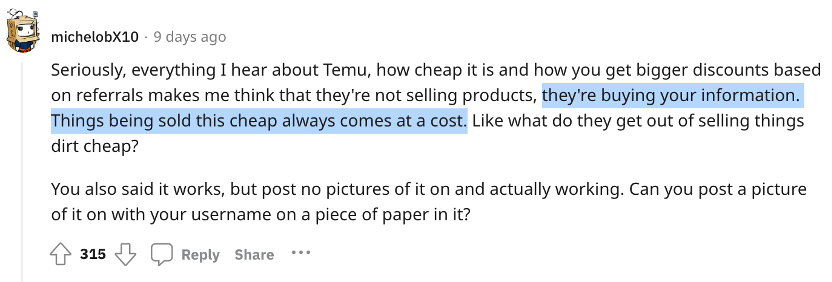

- Personal privacy breaches. Some users suspect that Temu might exchange low-priced goods for users’ personal information, which could serve as the primary source of profit for Temu.

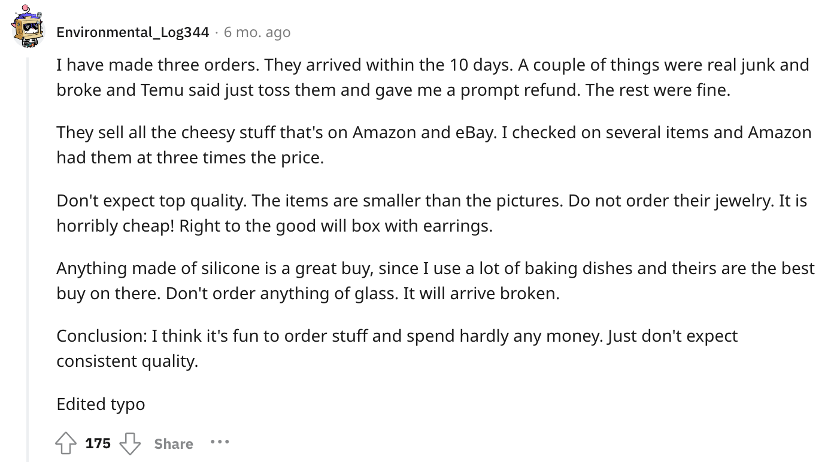

- Lack of expectations for product quality. Many users consider Temu to be akin to “Wish 2.0”, or even worse. Despite Temu’s efforts to improve product quality through self-operated model, users’ perception of this improvement seems limited. Some users express that spending on Temu is “generally worth the money, but half of the items in an order might have quality issues.”

In fact, we believe that Temu’s current low prices are primarily supported by cash flow subsidies from its parent company, rather than through labor exploitation. Additionally, under the stringent personal information regulations in the United States, the risk and reward of profiting from reselling personal information are not proportional and do not align with Temu’s original intention of expanding its overseas business.

However, these pieces of information undoubtedly reflect the lack of trust from the American public in Temu. Temu may need to consider how to reshape the perception of its low-price positioning in the minds of users.

As for the criticism regarding product quality, given Temu’s strategy of pursuing extremely low prices, there might indeed be a higher likelihood of quality issues with many products. This is a challenge that Temu will need to allocate significant resources to overcome in the later stages; otherwise, it could potentially repeat the mistakes of Wish.

- Dissatisfaction with Temu’s Marketing Strategies. Within the posts garnering significant likes, American users have expressed their dissatisfaction with Temu’s marketing strategies in two main aspects:

-

Displeasure with Temu’s Brainwashing Marketing: Some users have reported that Temu’s products and services do not align with its advertising slogan, “Shop Like a Billionaire.” These users believe that billionaires would not purchase such low-cost products. Temu’s heavy investment in advertising may be backfiring.

-

Suspicions of Temu as a Scam: Until June 2023, “Scam” has consistently been one of the most common keywords in Reddit’s “Temu” search results. Users generally find Temu’s offerings perplexing: on one hand, the low prices raise concerns about product quality and personal privacy, and on the other hand, the user experience is disjointed from the advertising claims. Furthermore, many American users have had poor shopping experiences with Wish, leading to heightened caution regarding Temu.

Currently, Temu’s impression among the American public bears a striking resemblance to Pinduoduo’s early days in China. Pinduoduo gradually improved its brand image among consumers, mainly through substantial subsidies and the support of social networks like WeChat. However,unlike Pinduoduo, Temu lacks the flow of WeChat’s user base, and given the overall financing challenges faced by Chinese internet companies, it remains uncertain whether Temu will have the capacity and resources to improve its image among the American public.

Additionally, we’ve observed that executing Pinduoduo-style viral marketing in the United States is not straightforward. During this research, Reddit had already closed numerous Temu invite code sharing subreddits and posts, whereas WeChat had a relatively open attitude toward viral marketing sharing in Pinduoduo’s early days.

In conclusion, it is likely that mainstream research reports have underestimated the differences between American consumers and Chinese consumers. Compared to Chinese consumers, American consumers place greater emphasis on labor welfare and personal privacy, implying higher trust-building costs. Moreover, the internet landscape in the United States is vastly different from China’s. Without the support of WeChat’s user base and facing stricter regulations on viral marketing, Temu may encounter customer acquisition costs beyond what the management team anticipated.

Temu Team’s Previous Work: Duoduo Grocery

Mainstream research institutions generally view the Duoduo Grocery team favorably, believing that it rapidly captured a significant portion of the online fresh produce market in a short time. However, public opinions differ significantly.

-

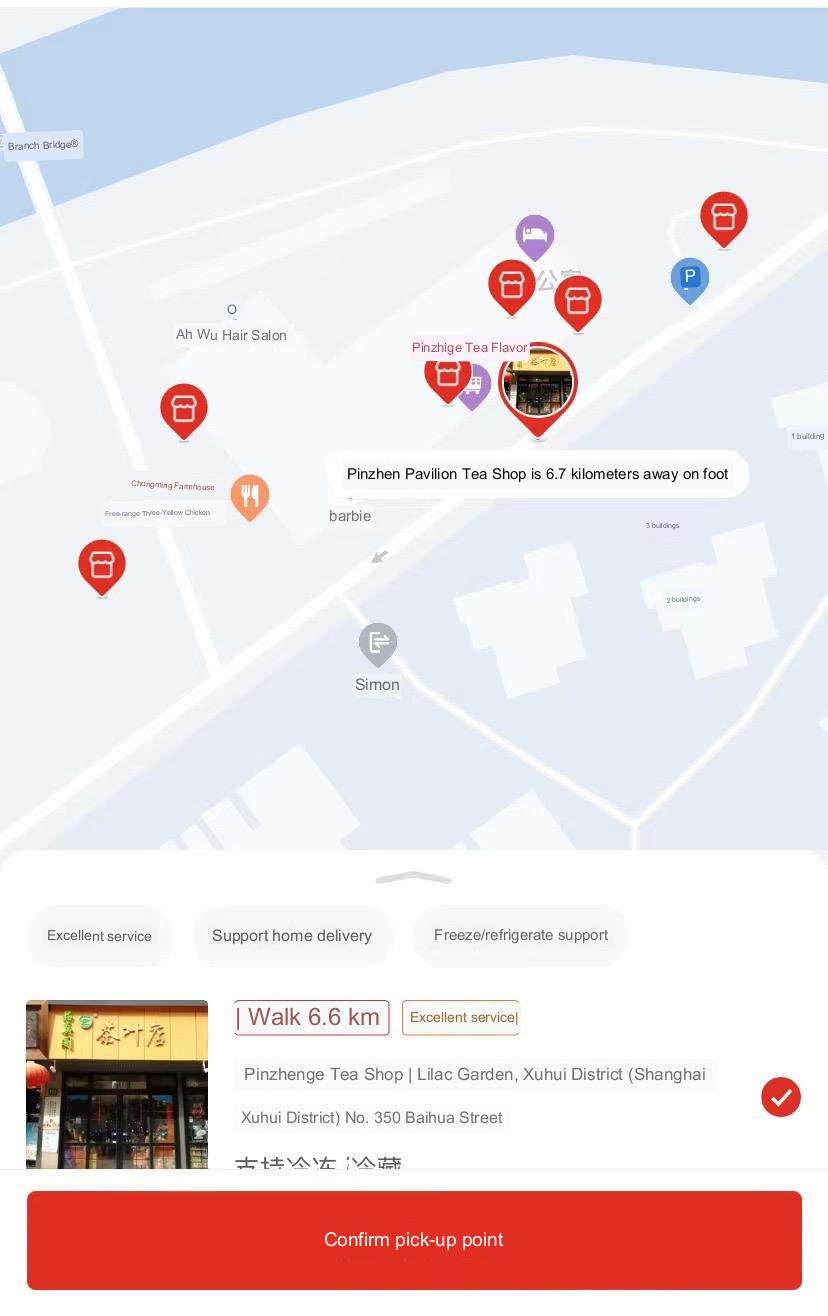

Consumer Side: The fluctuation in pickup point quality has been a source of criticism.

-

On one hand, pickup points vary significantly in terms of hardware facilities. Small, low-traffic offline stores like tea shops and laundromats have become ideal hosts for Duoduo Grocery. Some users have reported that certain pickup points lack refrigerators. In our own test orders, pickup points often managed goods haphazardly, requiring consumers to spend over 10 minutes sorting their orders from a pile of items. This model inevitably leads to numerous order mismatches. In our test, a 500g order of grape was divided into two boxes (each containing 250g), and consumers could easily take the wrong items without checking the order weight.

-

On the other hand, pickup points depend on store ownership, and store transfers or closures are not uncommon. When a store closes or changes ownership, it not only affects the current orders but also necessitates a lengthy process for custumers to rebuild trust with other pickup points.

-

- Supplier Side: Some suppliers have complained about Duoduo Grocery’s bidding system, suggesting that in this competitive environment, the likelihood of inferior products displacing high-quality ones is high.

Question:How’s the experience shopping on Duoduo Grocery

Reply of a disspointed vegetable farmer:

I’m a vegetable farmer, and I’ve been a supplier on DuoDuo Grocery for three months now. In January this year, someone from my village who works as a quality inspector at DuoDuo Grocery approached me, suggesting I become a supplier on their platform. Since most people these days prefer to stay home and order groceries through their phones, the prospect seemed promising. Plus, it was a fellow villager, so I trusted the recommendation. After completing the necessary procedures, I embarked on the journey of being a supplier.

I cultivate celery, and since there aren’t many celery suppliers on DuoDuo Grocery, I became the sole provider. This unique position allowed me to sell over a thousand portions per day, with each portion weighing 300 grams. After accounting for expenses like plastic bags, labor, and shipping fees, I could make about 2 cents per portion. This translated to three to four hundred dollars a day, which is ostensibly more than what many people make. However, things took a turn after just two weeks. Suddenly, they informed me that they no longer needed my celery. When I inquired about the reason, the folks at DuoDuo Grocery brushed me off, claiming they simply weren’t planning to offer celery anymore. I was left speechless. I could sell my produce at the local market, but a couple of days later, I saw celery back on DuoDuo Grocery’s shelves.

I asked that same acquaintance to inquire on my behalf. He found out and told me that it was because the other supplier was selling their celery for two cents less per portion. I bought a portion myself and was disappointed with the quality. I couldn’t fathom why such subpar produce was being put up for sale. The quality was so poor that I doubted anyone would want it. As expected, within days, negative reviews flooded in, sales plummeted, and the celery was taken down. Then, DuoDuo Grocery approached me again, asking me to continue supplying. This time, they wanted 150-gram portions, but at half the price. It seemed their strategy was to cut costs by reducing portion size and price, attracting more customers. And it worked—within days, they were selling over three thousand portions daily.

But for me, it became a headache. Costs went up; with more portions, my employees couldn’t keep up, necessitating hiring another person. Plastic bag usage doubled, and each crate could only hold fifty portions. Previously, 300 grams were fifty portions, and now, even with 150 grams, it was limited to fifty portions, requiring extra trips and fuel. Now, making two hundred dollars a day was a blessing. Then came the troubles. Due to an employee’s mistake, one crate was short by ten portions, resulting in a fine of four thousand dollars. That was relatively mild—another supplier who sold cabbage faced even worse. They sold over eight thousand portions daily, and due to oversight, two crates were left behind, incurring a fine of forty-five thousand dollars. After half a year, they practically worked for nothing. There were many similar incidents.

So, to those considering joining in, I’d advise careful consideration. As for me, I’ll quit once my contract is up. And to all the suppliers on DuoDuo Grocery, I have this to say: for those who criticize the quality of the produce, look at the prices. Farmers like me are in the minority; most source from us and resell to DuoDuo Grocery to make a profit from the margin. They can’t afford good produce, so they end up with second-rate goods. One mishap wipes out half a month’s earnings. If not for the contracts, many would have left already. Customers aren’t happy with the quality, suppliers aren’t making money, but DuoDuo Grocery is thriving. These days, we suppliers have a saying: we use the money from selling produce to pay our employees’ salaries; the fines are where DuoDuo Grocery really makes its money.

In conclusion, while Duoduo Grocery may indeed possess the ability to leverage smaller capital to gain a larger market share in the early stages of the project, they may weaken the importance of maintaining user experience and supplier relationships in exchange. The latter is a crucial factor in whether the project can achieve long-term profitability.

Conclusion

Temu has shown promise in its early stages of business expansion, but it remains unclear whether it can sustainably enhance user experience, maintain mutually beneficial relationships with suppliers, and withstand the fierce competition for overseas traffic. Based on current American public sentiment and Temu’s team’s past experiences, the future development of Temu does not appear optimistic. The next steps will need to focus on how Temu can improve user experience and transform its brand image to avoid slipping into a scenario akin to becoming “Wish 2.0.”